Get Started With

servzone

Overview

Companies Act 2013 gave birth to the concept of One Person Company. Section 2(62) of Companies Act defines ‘One Person Company’ as “a company run by a single person who is acting as a shareholder and director at the same time”. One Person Company Registration has lower compliance as compared to a Private Limited Company.

In the early stages of their business, entrepreneurs prefer to create OPCs rather than sole proprietorship businesses, because the OPCs that provide the benefits.

What is OPC?

The OPC or One Person Company can be formed with one person who is the owner and director of the company. It was introduced under the company’s Act, 2013. A one-man company registration is a type of sole proprietorship business as a company which gives the sole right of the individual to run the business while limiting its liabilities and duties to the business.

Benefits

Most business employees prefer to register a private limited company due to their special benefits but are unaware that One Person Company registration may provide them with better opportunities with very little compliance.

Some benefits:

- Ease In Funding

Like a private limited company, OPC can also raise its fund through financial institutions, angel investors, venture capitals, etc. An OPC can also graduate in a private limited company to raise its funds.

- Better Opportunities

OPC has better opportunities and benefits with limited liability according to which the company will be limited to the value of the shares you hold. One-man company registration gives you more chances to take risks and explore better opportunities without any pressure to lose on personal property. Therefore, it is an encouraging option for young, new and new entrepreneurs..

- Incorporation With Least Requirements

No one can beat the OPC when it comes to introducing minimum requirements to a company. You can start OPC by meeting the requirements below.

In this case, shareholders and directors can be the same person and must be a citizen of India. Due to little compliance and burden, an individual has more time to focus on their company and functional areas.p>

- Benefits for Small Scale Industries

An OPC can take advantage of all the benefits provided to small scale industries such as easy money without accumulating security to a certain extent, loans at low interest rates, benefits under foreign trade policy, etc. These benefits play a significant role in the progress of the company. Its opening day.

- Recognized As A Trustful Separate Legal Entity

Any business which is registered under the Companies Act, 2013 and has a separate legal entity and which is considered more reliable than the non-registered ones.

Required Documents

OPC registration is an easy process but to complete it you need to collect all the documents given below.

- Identity proof of the director and nominee

You will be required to produce proof of identity of the director and the nominee. This can be either their voter card, Aadhaar card, driving license, PAN card etc.

-

Memorandum of Association (MOA) and Article of Association (AOA)

Both these documents are very important and presented during the registration process. Be sure to highlight all the objectives of your company before presenting.

-

Consent of the designated Nominee

As previously discussed, starting the OPC requires a director and a nominee. In case of any mishap, the nominee has the right to replace the director, so that the business of the company wins.’t be affected. The nominated candidate's consent is filed through Form INC-3. The nominee will also have to submit his PAN card and Aadhaar card for the proceedings.

-

Affidavit of nominee and director

The designated director and nominee have to submit their affidavit in form INC-9 and DIR-2

- Residential Proof of the office

Residential proof of the place where commercial activities are conducted is presented at the time of registration. It cannot be a utility bill (electricity, gas, telephone) older than two months attached to the proof of ownership with no objection certificate. If you are working on a rented property, you will have to submit a rent agreement with all the documents.

-

PAN card

A copy of the PAN card of the director and nominee would be submitted during the OPC registration process.

-

Passport Size Photographs

Passport size photographs of the designated director and nominee would be attached along with the form.

-

DSC and DIN

Both these documents are essential for the OPC registration purpose. DSC is used to sign the online documents while DIN provides a unique identification number to the director.

- Can incorporate an OPC

- Can be a nominee for the member of the company

- He/She should be staying in India for at least 182 days from the prior one year.

- In case the turnover limit of OPC exceeds Rs 2 crores, it has to be turned into a Private limited or a Public Limited company within a time duration of 6 months

Eligibility Criterion

following conditions:

Only a person who is a citizen of India

Salient Features

- New Concept

OPC is a new concept governed by the Ministry of Corporation under the Companies Act, 2013.

- One Shareholder

It requires only one shareholder to establish a One Person Company in India. The shareholder must have stayed in India for the minimum period of 182 days, hence should be an Indian resident.

- An Immediate Nominee

Although the company can be started with a single person, there must be a designated person who can take responsibility of the shareholder in the extreme case of death or disability. The nominee must be an Indian citizen and must give his or her consent as an OPC shareholder nominee. A company functions like a separate legal entity under OPC registration.

- One Director

A private limited company requires a minimum of two directors, while a public limited 7 is required, but the OPC may be formed with a minimum of one director, who may be the shareholder and owner of the company itself. The maximum number of directors in an OPC can be 15.

- Fewer Compliances

According to the Act, an individual company can be formed with a single member and director and, therefore, has less compliance than a private limited company.

- Separate Legal Entity

Just like private and public limited companies, OPC is also a separate legal entity.

- Limited Liability

Under the One Person Company registration a company benefits with the limited liability of its directors according to which personal property and money cannot be used to provoke the company's debts.

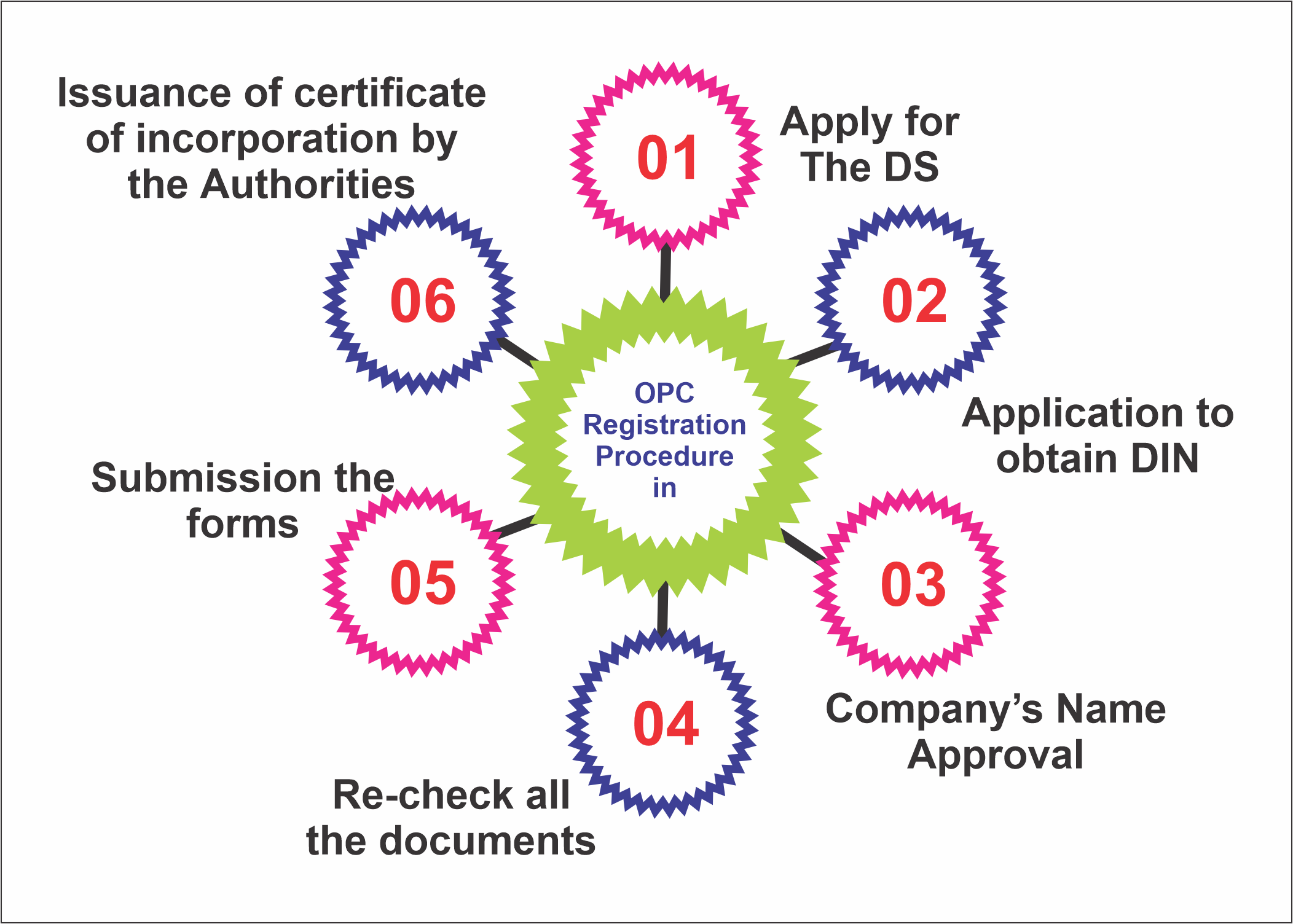

Registration Procedure

OPC registration is an online process, which is done as per the provisions of the Companies Act, 2013. Here are the steps you need to take to get your registration:

- Apply for DSC

The DSC is received by the Director to sign all the online documents. It can be obtained from nearby agencies; The fees for obtaining a DSC vary from agency to agency.

- Application to Obtain DIN

Director’s Identification Number can be filed along with the SPICe+ form. All you need is the name and residential proof of the designated director. Before January 2018, Form DIR-3 was used to obtain the Director’s Identification Number. But now applicant can obtain DIN for three directors along with SPICe+ form.

- Company’s Name Approval

Once you have obtained DSC and DIN, now it’s time to decide the name of the company and get it approved by the Ministry of Corporate Affairs. Name of the company should be in the format of “XYZ (OPC) Private Limited.”

- Re-check all the Documents

It’s quite obvious no one wants to resubmit their documents, so it’s better to recheck them And make sure that all documents are in the exact format. Check if your PAN card details match with your other proof such as address proof details. In case of some spelling mistakes, correct it before submission.

- Submission of Forms

After uploading the documents, Form 49A and Form 49B will be prepared for the company PAN and TAN. You can use them to file the PAN and TAN of the company which will further help you to open a bank account for the company.

- Issuance of Certificate of Incorporation by the Authorities

All documents and forms are verified by the authorities. Once verified, the Registrar of Companies will issue a certificate of incorporation which will contain the CIN number.

One Person Company Registration cannot be done without submitting above mentioned documents.

Difference Between OPC and Sole Proprietorship

A sole proprietor business may seem similar to a One Person Company in many ways but there are actually some differences between the two.

The major difference is in the nature of the liabilities they bear. An individual company has its own assets and liabilities. It is a separate legal entity separate from its promoter. The promoter of OPC is not personally liable to repay the debts of the company.

In case of sole proprietorship the proprietor and the promoter are the same persons. So, the law allows the attachment and sale of promoter’s own assets in case of non-fulfillment of the business’ liabilities.

GST Registration

PVT. LTD. Company

Loan

Insurance